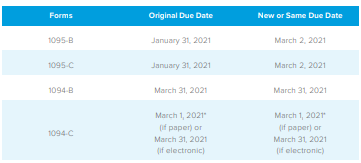

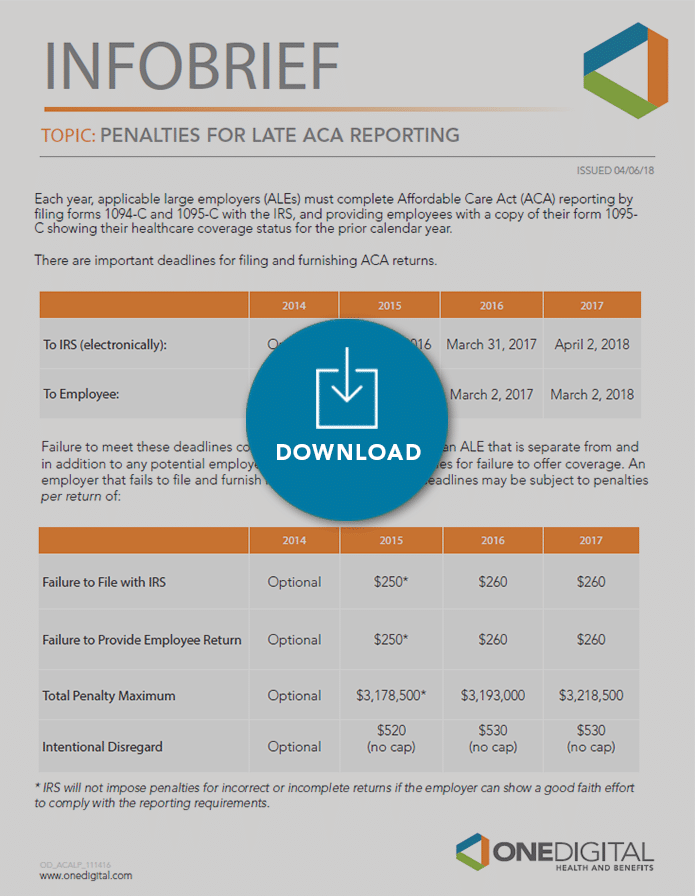

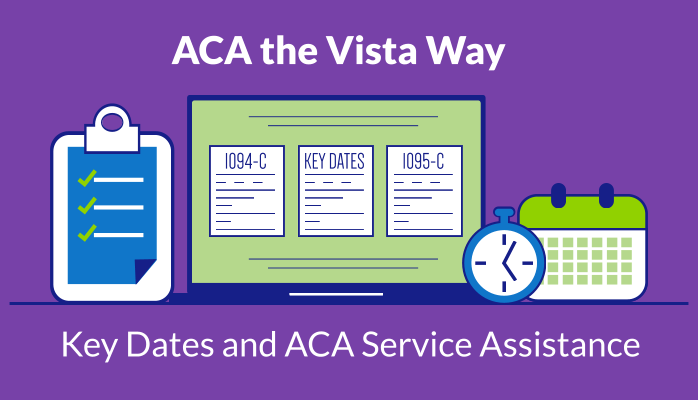

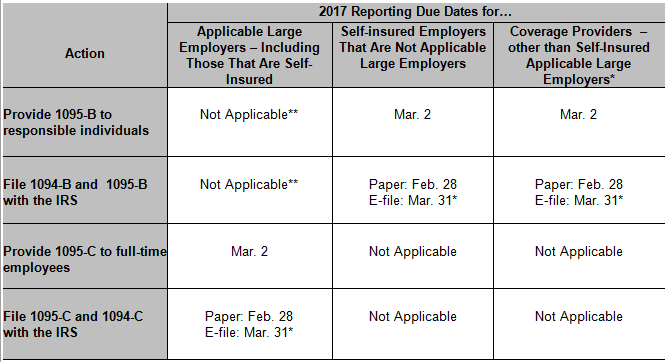

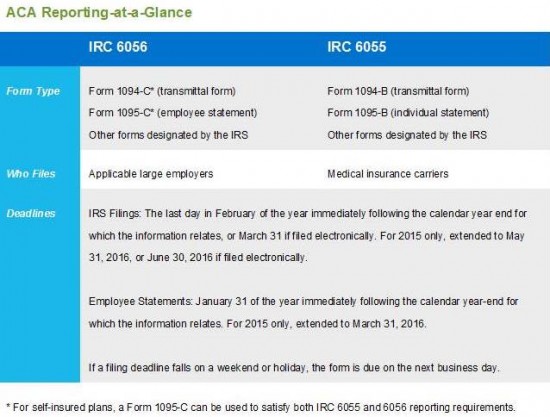

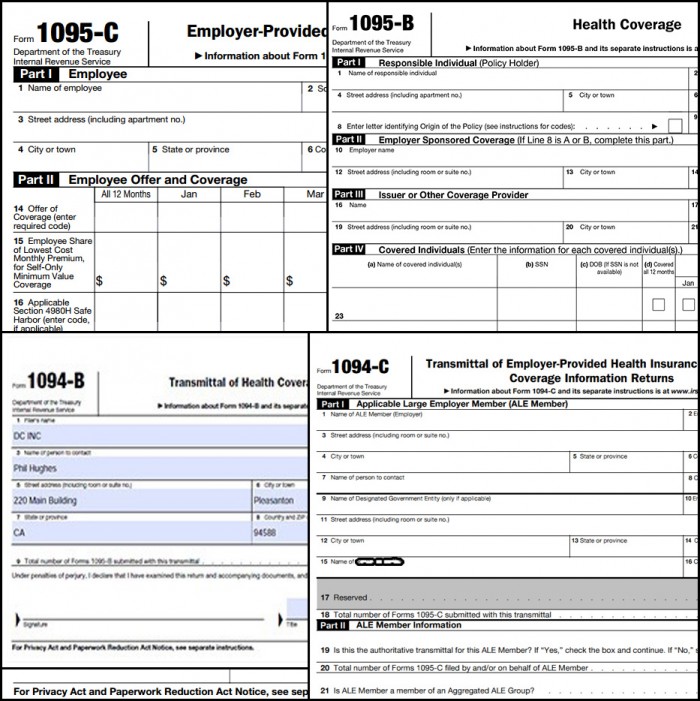

Therefore, Notice 76 does not extend the due date for filing Forms 1094B, 1095B, 1094C or 1095C with the IRS for This due date remains , if filing on paper (since , is a Sunday);PDS offers ACA services to assist customers in successfully delivering IRS Form 1095C to their employees and reporting IRS Form 1094C to the IRS UPDATED The deadline to report has been extended to UPDATED with additional guidance from the California Franchise Tax Board Fully insured employers whose carrier distributes Form 1095B to California plan participants satisfy their form distribution obligation under the CA Individual Mandate

Finally Some Good News California S Franchise Tax Board Delays Individual Mandate Reporting And Disclosure Deadlines

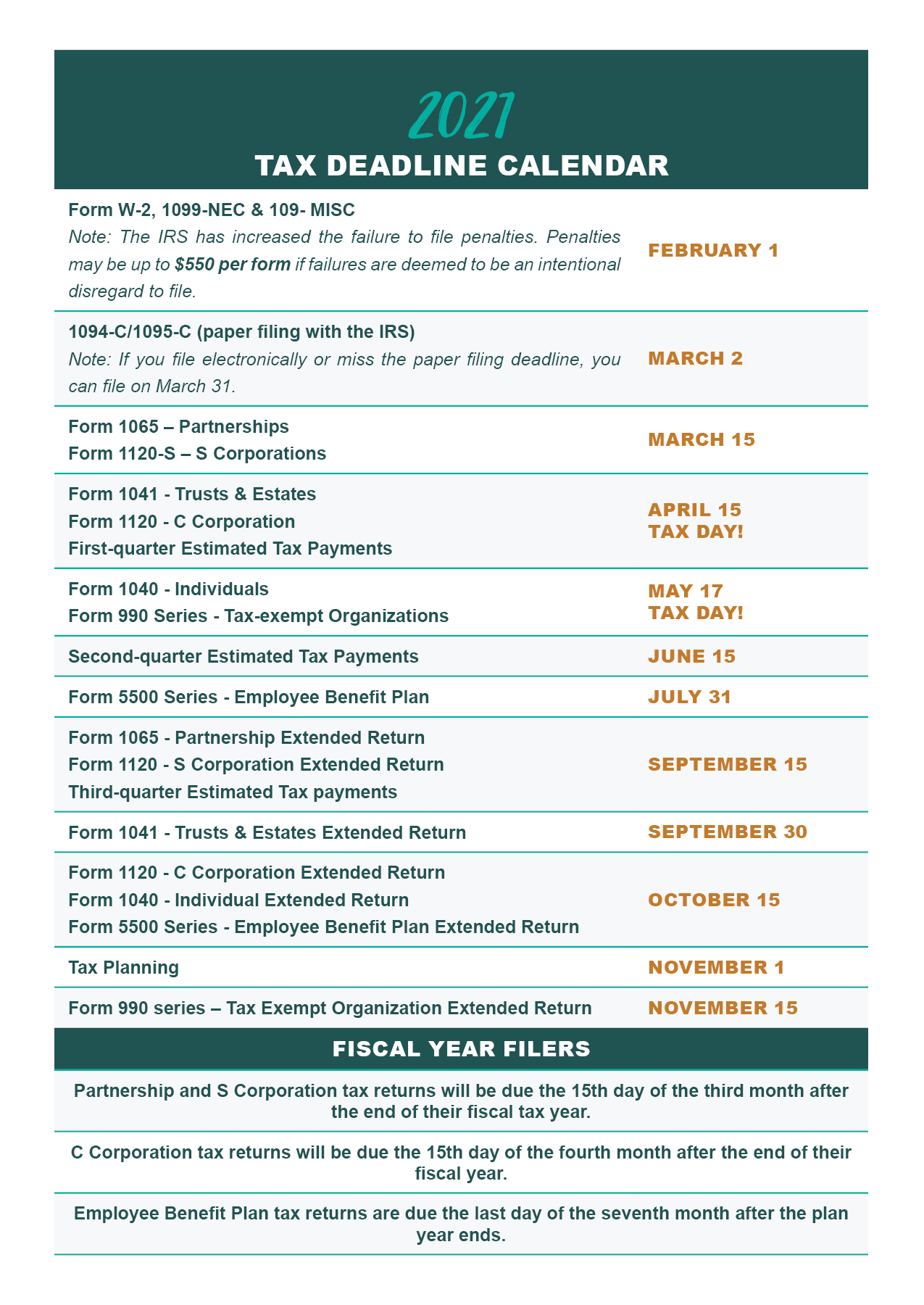

1094-c filing deadline 2021

1094-c filing deadline 2021-1095 deadline 1921 Fill out forms electronically using PDF or Word format Make them reusable by creating templates, include and fill out fillable fields Approve documents by using a lawful digital signature and share them by using email, fax or print them out download documents on your computer or mobile device Increase your productivity with powerful solution? Deadline to transmit 1095C print file to PDS;

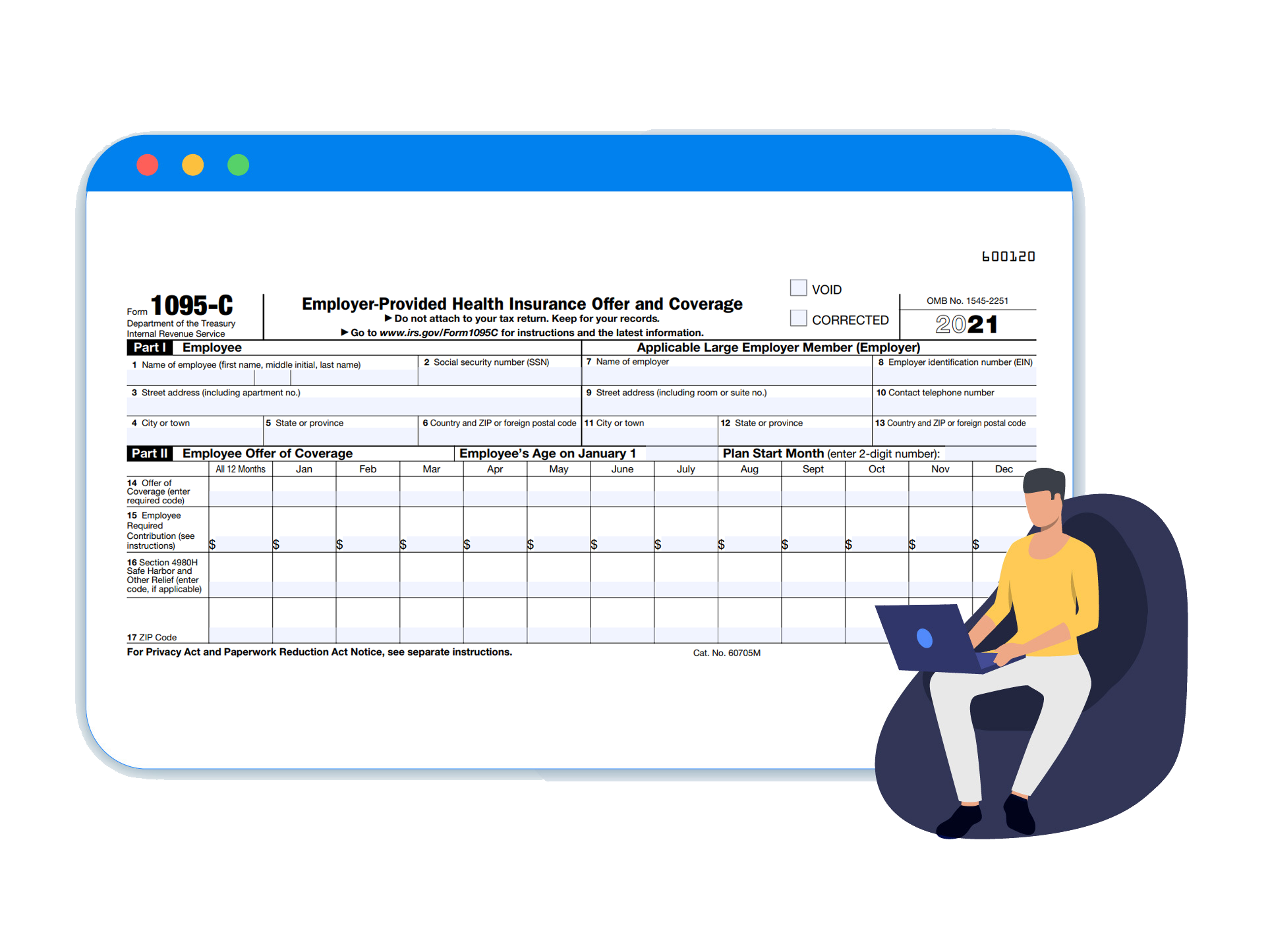

Irs Issues Draft Form 1095 C For 21 Aca Reporting

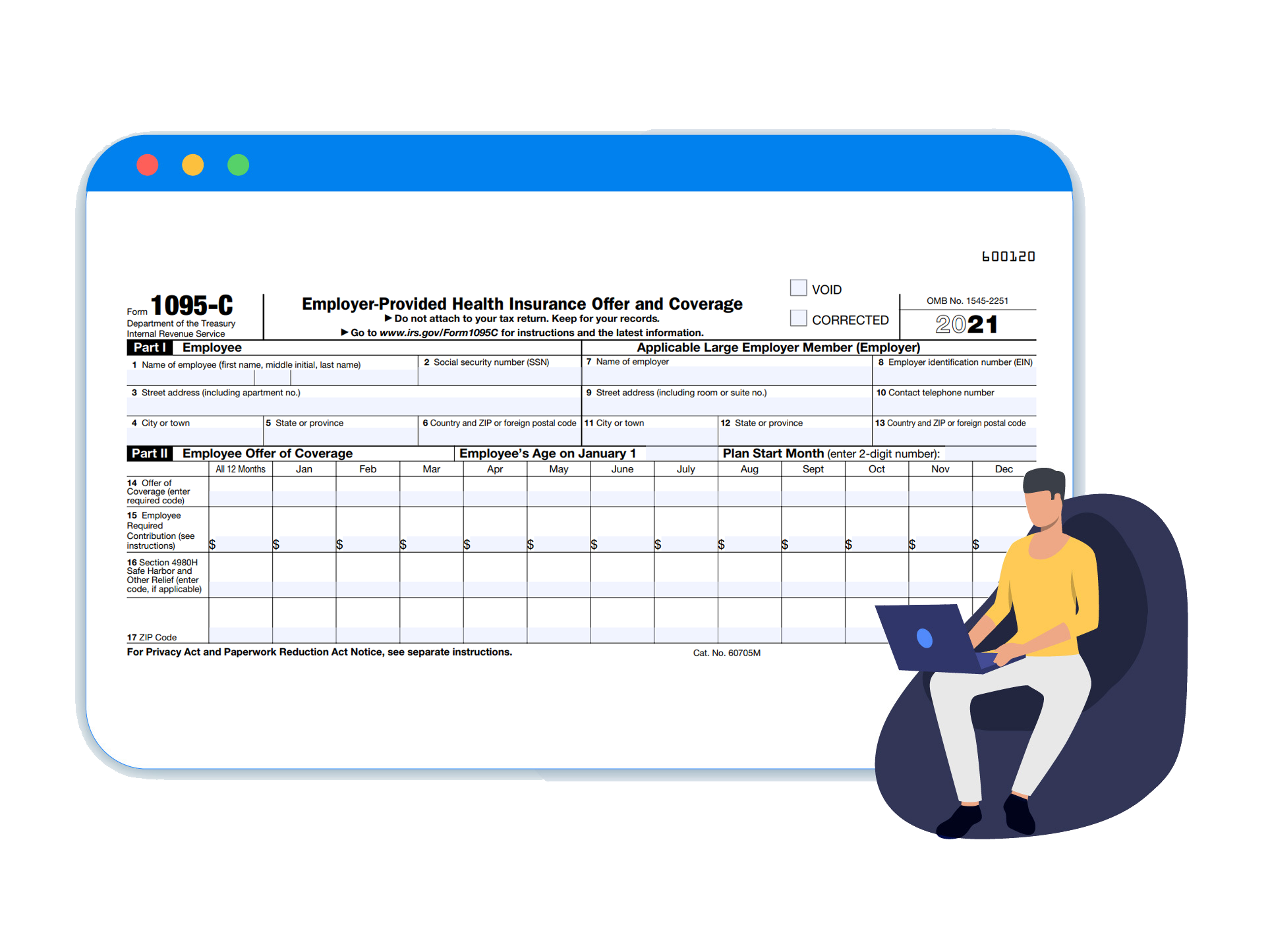

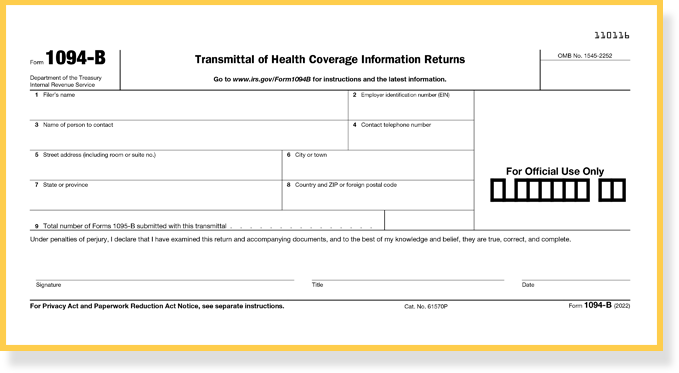

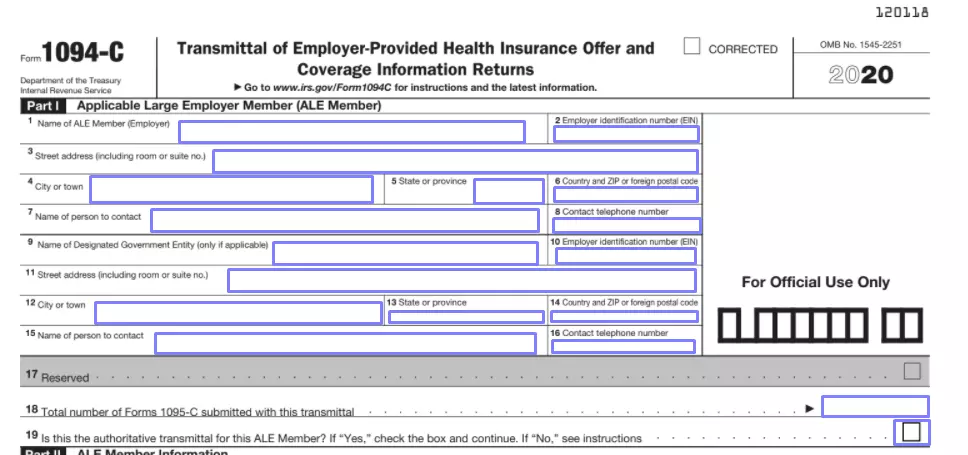

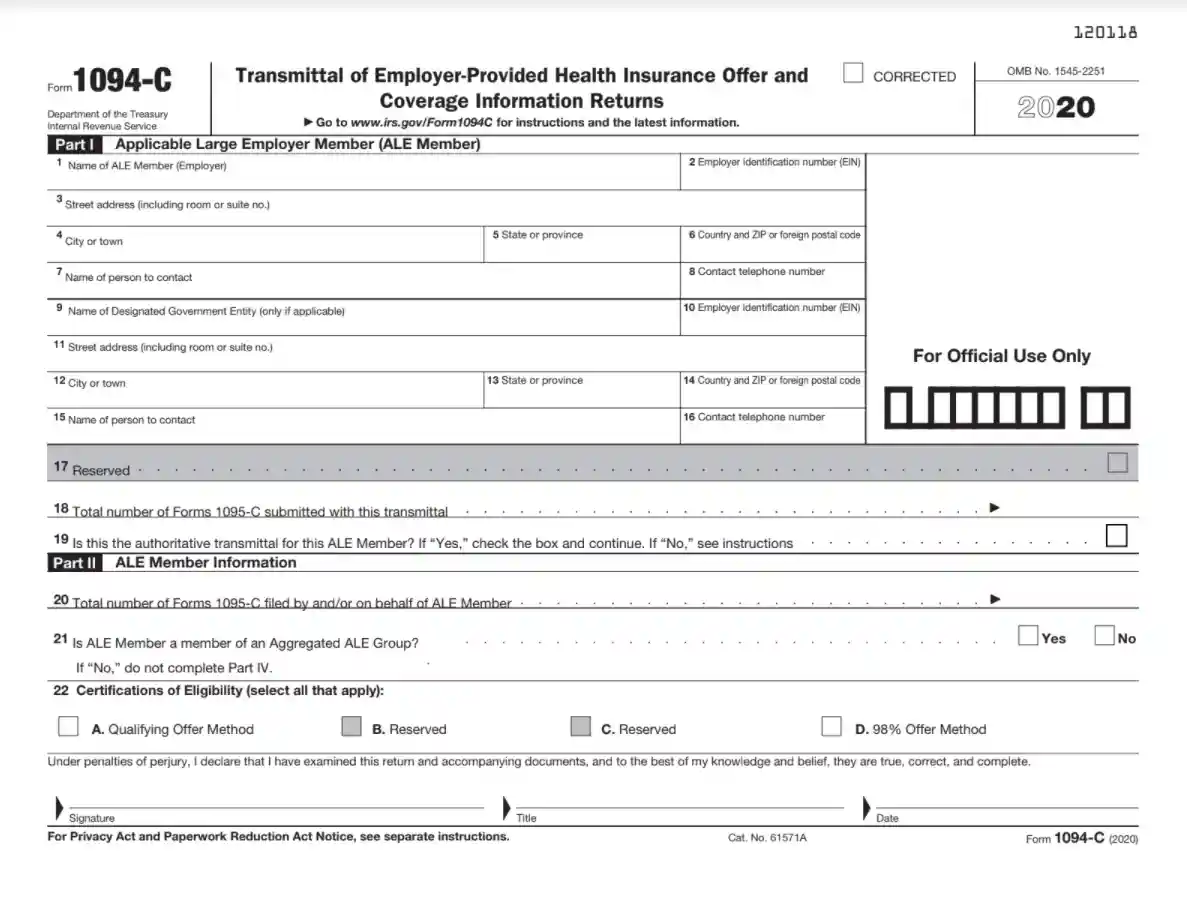

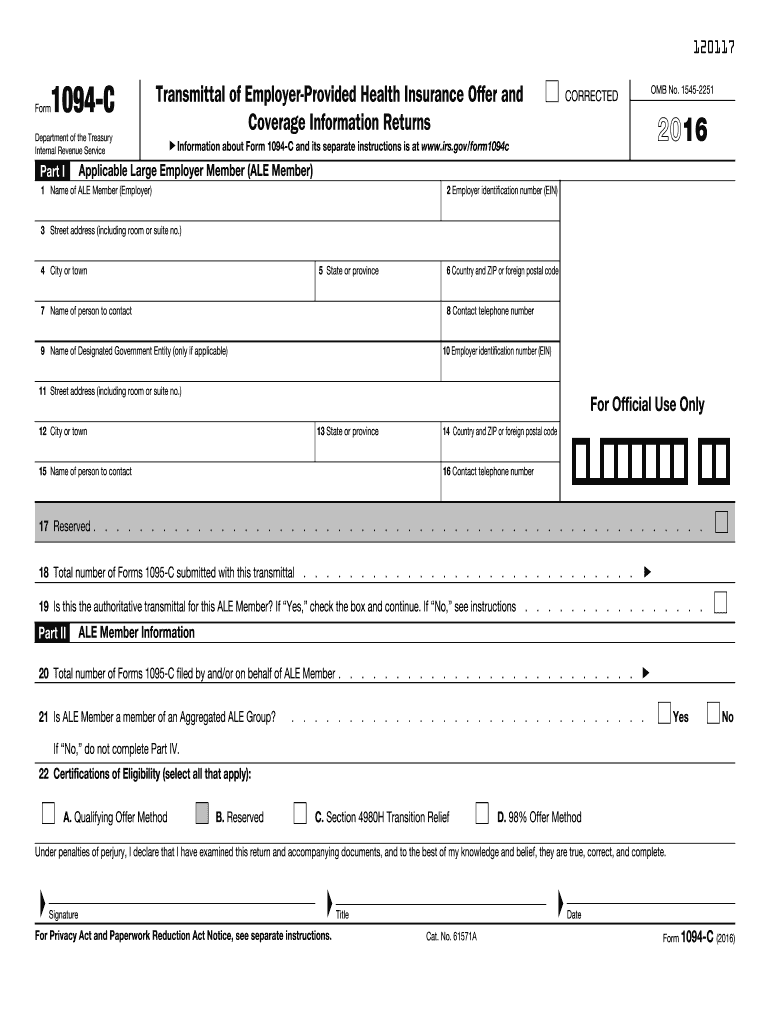

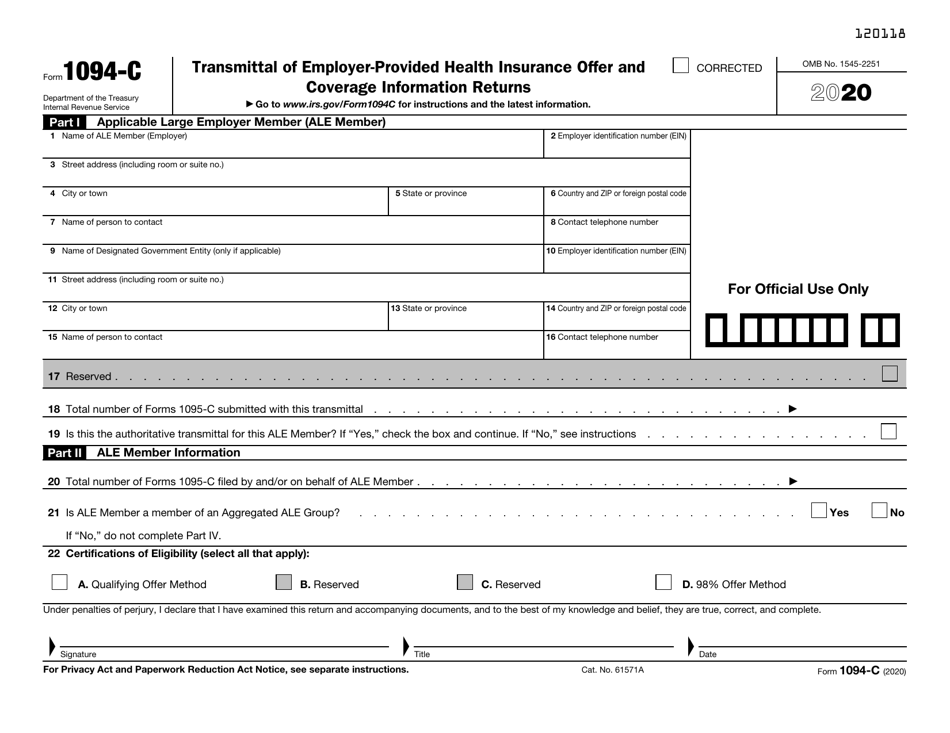

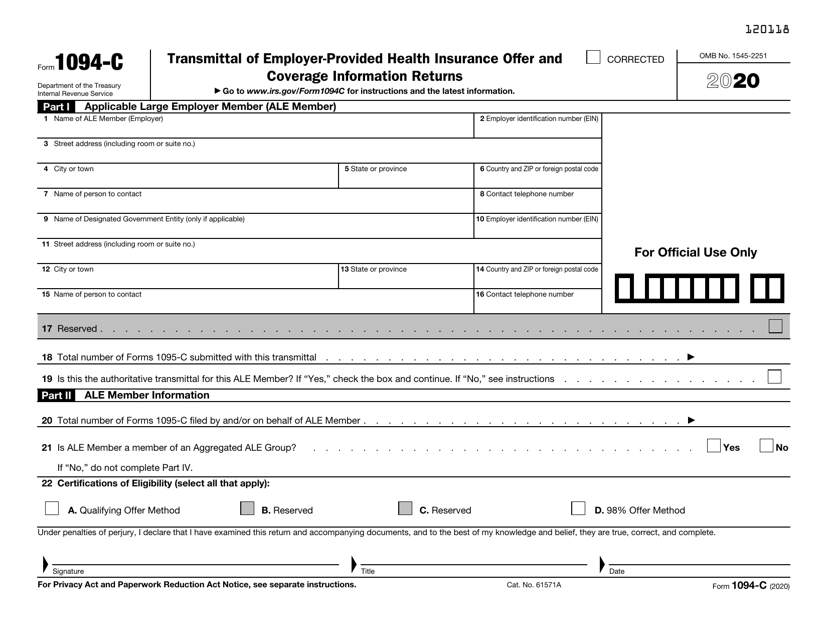

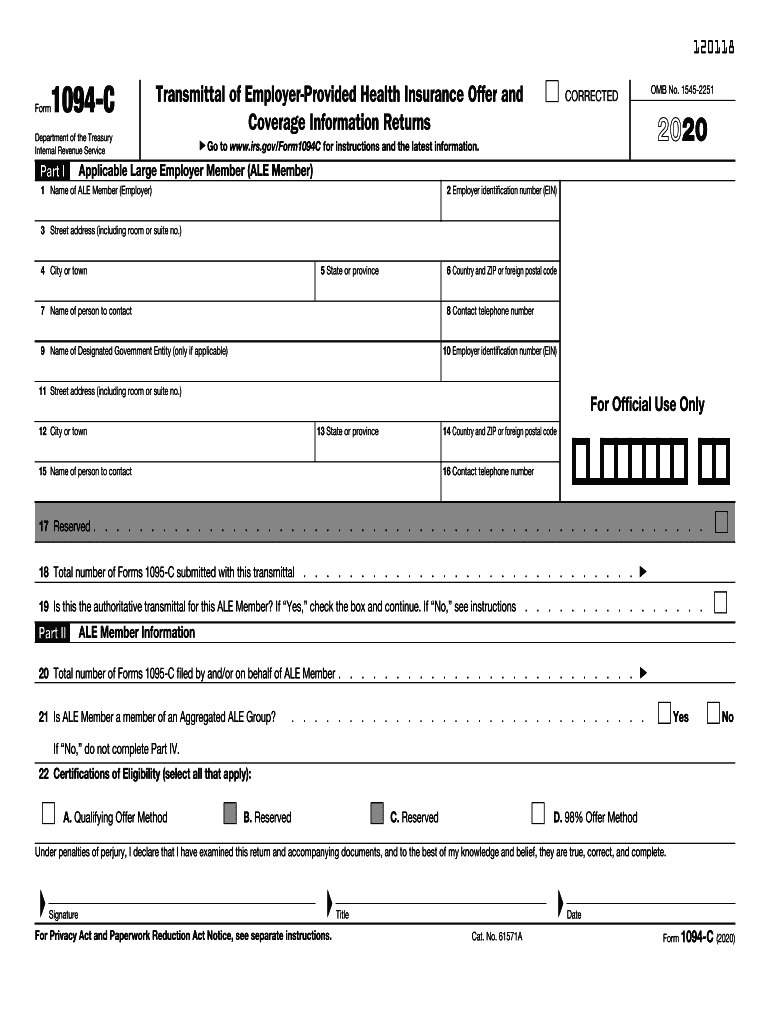

Information about Form 1094C, Transmittal of EmployerProvided Health Insurance Offer and Coverage Information Returns, including recent updates, related forms, and instructions on how to file Form 1094C is the transmittal form that must be filed with the Form 1095CACA 1094 and 1095B/C Reporting Deadlines for EFiling is for the states California, Massachusetts, New Jersey, 1098T EFiling Deadline Form 1098T Reporting Deadlines for EFiling is is the deadline to paper file forms 1094C and 1095C with the IRS for the tax year This applies to employers with total form counts (less than 250) who can elect to paper file their ACA information filings with the IRS

When is the due date for paper filing 21 ACA Forms 1094 and 1095B/C? The typical 30day extension to furnish information statements will not be granted in addition to the new deadline Also, the filing deadlines were not extended for Forms 1094B, 1095B, 1094C, or 1095C with the IRS, all of which must be filed by , or efiled by The term "filing" means submitting the forms to the IRS, either electronically orA You need to file Form 1095B/C with the District of Columbia before the due date to avoid unnecessary penalties The Form 1095B/C deadlines are given below The deadline to distribute copies of 1095B/C to employees is The deadline to submit 1095B/C forms to the State of District of Columbia is

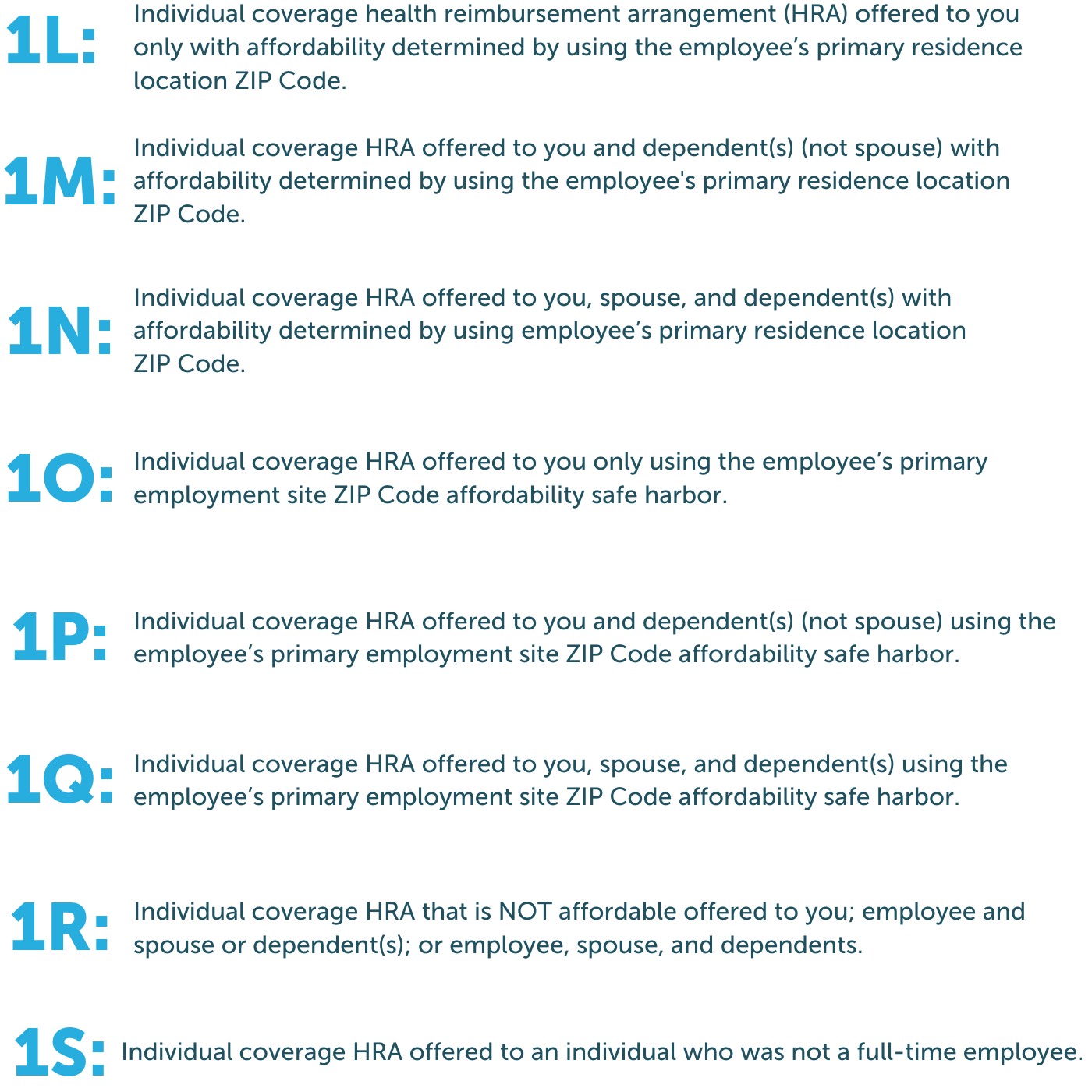

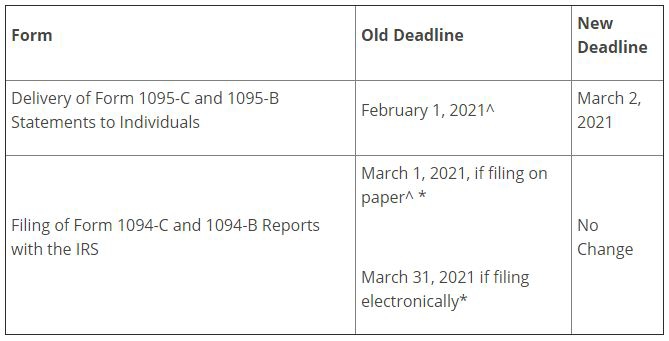

The IRS announced it would extend the deadline to March 2 from Jan 31 for employers to provide employees with a copy of their 1095C Jul 26 Written By Justin Romero In July 21, the Internal Revenue Service (IRS) issued an early release draft of Form 1095C—an important ACA reporting document While not ready for publication and use just yet, human resources departments should take note of a few updates to Form 1095C—and prepare for potential changes to 1094CsACA Filing deadline for 21 Employers should know the updated ACA 1094 and 1095B/C reporting deadlines for 21 Learn More ACA Form 1095C Code Sheet To report the health coverage information on Form 1095C, ALEs clearly understand the

2

Irs Extends Due Dates For Aca Reporting And Renews Penalty Relief Lexology

The Notice does not extend the Form 1094B and Form 1094C filing date with the IRS, which will remain at for paper filers and if filing electronically However, reporting entities who need additional time to file are able to request an extension from the IRS, is the paper filing deadline for the 21 Tax Year IRS mandates electronic filing for those who are reporting more than 250 Forms In July 21, the Internal Revenue Service (IRS) issued an early release draft of Form 1095C—an important ACA reporting documentWhile not ready for publication and use just yet, human resources departments should take note of a few updates to Form 1095C—and prepare for potential changes to 1094Cs

Employee Benefits Columbus Ohio Deadline To File Extension For Forms 1094 C And 1094 B Clearpath Benefit Advisors

Aca Employer Reporting Requirements 1094c 1095c Efile4biz

, to This notice also provides relief from the section 6721 and section 6722 penalties for certain aspects of the informationreporting However, (or if filed electronically) remains the due date to the IRS for Forms 1094B, 1095B, 1094C and 1095C The notice also provides an extension of relief for sections 6721 and 6722, stating that penalties will not be assessed if specific good faith efforts have been attempted The deadline for filing Forms 1094B, 1095B, 1094C or 1095C with the IRS remains , or , if filing electronically As a reminder, employers who are filing more than 250 of these reporting forms are required to file electronically

Irs Releases Aca Forms 1094 C And 1095 C Final Instructions

2

IRS Distribution Deadline Tax Year 1095 Distribution Deadline Affordable Care Act Form 1095 postmark by Looking for software to create and efile Forms 1094/1095B or 1094/1095C?For tax year , the deadline to furnish Form 1095C to DC plan participants is , and the deadline to submit Form 1094C and 1095C to OTR is If you have any questions, please contact the authors or one of the Miller Johnson attorneys listed to the left An ALE member must furnish a form 1095C to each of its fulltime employees by This is the deadline to electronically file forms 1094C and 1095C for the reporting year Also, deadline for the New Jersey State Filing and California State Filing Deadline for District of Colombia Filing

What You Need To Know About Aca Annual Reporting Aps Payroll

Finally Some Good News California S Franchise Tax Board Delays Individual Mandate Reporting And Disclosure Deadlines

Employers must submit their ACA reporting (IRS Forms 1094/5B and 1094/5C) to the district Reporting deadline is 30 days after the IRS deadline for submitting 1095B or 1095C forms, including any extensions granted by the IRS (for forms, this means April 30,21) The other reporting obligations under Code §§ 6055 and 6056 were not provided an extension Thus, insurers must still file the Form 1094B with the IRS by , and employers will need to file their Form 1094Cs by * (if paper), or (if electronic), with the IRS (see chart below)1094c deadline 1921 Complete forms electronically using PDF or Word format Make them reusable by generating templates, add and fill out fillable fields Approve forms by using a legal digital signature and share them through email, fax or print them out Save forms on your PC or mobile device Boost your efficiency with effective solution!

Large Employers What Are The Deadlines For Forms 1094 C And 1095 C Mitchell Wiggins

Common Mistakes In Completing Forms 1094 C And 1095 C

Know your ACA reporting requirements for tax year and efile your ACA 1094/1095 Forms before the 21 deadline Avoid receiving ACA penalty letters and paying millions of dollars as penalties! Submission to the IRS Forms 1094C, 1095C, 1094B, and 1095B forms must be filed with the IRS by if filing on paper (or March 31 if filing electronically) Electronic filing is mandatory for entities required to file 250 or more Forms 1095 Submission to employees In IRS Notice 76, the IRS extends the deadline for this IRS Forms 1094C and 1095C are filed by employers that are required to offer health insurance coverage to their employees under the Affordable Care Act, also known as Obamacare The main difference between them is that the 1095C provides information about health insurance and is sent to both employees and the IRS, while the 1094C acts as a cover

1094 C 1095 C Software 599 1095 C Software

2

DOL Forms and Q&A on Forms 1094C and 1095C The information reported on Form 1094C and Form 1095C is used in determining whether an employer is potentially liable for a payment under the employer shared responsibility provisions of section The filing deadline for Forms 1094B, 1095B, 1094C, and 1095C with the IRS remains February 28 th, 21, if filing by paper and March 31 st, 21, if filing electronically Sections 6055 and 6056 provide the IRS with the ability to grant extensions of up to 30 days for furnishing Forms 1095B and 1095C when good cause is demonstrated March brings a number of important deadlines for employers who sponsor a group health plan for their employees is the deadline for large employers and employers with selffunded plans to file certain Affordable Care Act forms with the IRS (Forms 1094C, 1095C, and Forms 1095B), if the employer is filing on paper;

Irs Issues Draft Of Updated 1094 C And 1095 C Forms For Tax Year Time Equipment Company

The 21 Dates Deadlines For Aca Reporting Are Imminent

For calendar year 21 Forms 1094C and 1095C are required to be filed by or if filing electronicallyExtensionsYou can get an automatic 30day extension of time to file by completing Form 09, Application for Extension of Time To File Information ReturnsDeadlines are subject to change and should be verified on wwwqualitynetorg To submit data for these measures and access reports, the ASC must have an active SA registered with QualityNet The deadline for submitting these measures is Note ASCs may voluntarily submit data for CY 21 and CY 22 for ASC11 but will not On , the IRS announced it would extend the deadline for employers to provide employees with a copy of their 1095C or 1095B reporting form, as required by the ACA, from

Groundhog Day Irs Delays Form 1095 C Deadline Graydon Law

Irs Issued Notice 16 4 Extending The Due Dates For Forms 1094 C And 1095 C For 15 Mnj Insurance Solutions

The electronic and paper filing deadlines have already passed for 19 ACA information Employers must provide this information to the IRS via Forms 1094C and 1095C ALEs must also provide a copy of Form 1095C to their fulltime employees, including to any person employed fulltime for one or more months of the reporting yearThe deadlines for filing Form 1095C with the IRS and furnishing copies to the recipient are as follows , is the deadline to distribute recipient copies , is the deadline to paper file Forms 1095C with the IRS , is the deadline to efile Forms 1095C with the IRSDo not offer to fulltime employees on forms 1094C and 1095C Under Section 6055, nonALEs that are selffunded must report information to the IRS about the health coverage they offer or do not offer to fulltime employees and their dependents on forms 1094B and 1095B FEBRUARY 21 Form W2 (including health care costs)

Missed The 1095 C Deadlines Now What Onedigital

2

IRS Issues Draft Form 1095C / 1094C for ACA Reporting in 21 Click here to learn more about the changes in ACA FormsDRAFT AS OF 21 Instructions for Forms 1094C and 1095C Department of the Treasury Internal Revenue Service Section references are to the Internal Revenue Code unless otherwise noted Future Developments For the latest information about developments related to Form 1094C, Transmittal of EmployerProvided Health Insurance Tax Year 21 Forms 1094B, 1095B, 1094C, and 1095C Affordable Care Act Information Returns (AIR) Release Memo, XML Schemas and Business Rules Version 10 AATS and Production Start and End Dates Posting Dates Start Date End Date AATS Date TBD Production Date TBD TBD Release Memo, XML Schemas and Business Rules

Aca The Vista Way Pds Blog

Acawise Time Is Running Out There Are Just Two Days Left Until The Aca E Filing Deadline Which Lands On March 31 21 We Will Generate 1094 1095 B C Forms E File It

ACA reporting requirements 22 for employers Know the instructions of IRS mandated Form 1094 & 1095B/C reporting under section 6055/6056, due date, 22 changes, if filing electronicallyFor calendar year , Forms 1094C and 1095C are required to be filed by , or , if filing electronically See Furnishing Forms 1095C to Employees for information on when Form 1095C must be furnished

Guide To Prepare Irs Aca Form 1094 C Form 1094 C Step By Step Instructions

Irs Form 1094 C Fill Out Printable Pdf Forms Online

Employers must electronically file the Forms 1094C and 1095C with the IRS no later than this date (As a note, for California employers, this is also the deadline for Pay Data Reporting) Failing to meet these deadlines can result in penalties under IRC 6721/6722, which the IRS is issuing through Letter 972CG If you receive one of these notices,Want to receive more information? The IRS has released draft Affordable Care Act (ACA) information reporting forms and instructions for 21 As a reminder, Forms 1094B and 1095B are filed by minimum essential coverage providers (insurers, governmentsponsored programs, and some selfinsuring employers and others) to report coverage information in accordance with Code § 6055

1094 C 1095 C Software 599 1095 C Software

The Instructions For Forms 1094 C And 1095 C Blog Taxbandits

Five Affordable Care Act Items Employers Should Know Heading Into 22 Soon employers will be in the middle of reporting the Forms 1094C and 1095C to the IRS for the 21 reporting season It is hard to believe, but this will be the seventh year of Affordable Care Act (ACA) reportingThe state's taxing authority, the Franchise Tax Board (FTB), has extended or effectively extended the deadlines in 21 for insurers and selfinsured employers with covered employees and dependents in California to provide them with Well, 21 is off to a contentious start politically, and coronavirus infections are surging again, but we have good news from California!

Deadline To File Extension For Forms 1094 C And 1094 B Ja Benefits Employee Benefits Indiana Kentucky Illinois Ohio

2

The ACA deadlines for furnishing copies to employees, paper filing, or efiling to IRS are as follows You must furnish Form 1095C to your employees by The due date for filing Forms 1094C and 1095C with the IRS is February 28th, 21 if filing by paper, and March 31st, 21 if filed electronicallyDeadline to transmit 1094C/1095C transmission files to PDS;IRS Filing Deadline (eFile) affordable care act forms 1094/1095B and 1094/1095C The links below are for Tax Year forms Form 1094B – Transmittal of Health Coverage Information Returns – Tax Year Form 1095B – Health Coverage – Tax Year Instructions for Forms 1094B and 1095B

Irs Issues Draft Form 1095 C For 21 Aca Reporting

Aca Reporting Road Map

The deadline to File Form 1094 & 1095B/C to the State Employers are required to file Form 1094 & 1095B/C to the California Franchise Tax Board (FTB) on or before this deadline

Aca Update Form 1095 C Deadline Extended And Other Relief

Aca Alerts The Benefit Companies Inc

1

1094 C Irs Transmittal For 1095 C Forms For 21 5500 Tf5500

Irs Form 1094 C Fill Out Printable Pdf Forms Online

Free Small Business And Hr Compliance Calendar March 21 Workest

Form 1094 C Instructions For Employers What You Need To Know

Shop Paper Products 1095 Forms 1094 C Brokerforms Com

Yearli Form 1095 C

Irs Extends Due Dates For Aca Reporting And Renews Penalty Relief

Irs Issues Aca Reporting Instructions For 21 Tax Year

Affordable Care Act Deadlines Extended For Notices Lexology

What Are The Form 1094 C And 1095 C Requirements For Fully Insured Health Plans In

Aca Employer Reporting Requirements 1094c 1095c Efile4biz

Irs Extends Employer 1095 Due Date Medben

Aca Compliance Filing Irs Forms 1094 C And 1095 C

Employer Deadline To Furnish Forms 1095 B C To Plan Participants Extended To March 2 Sequoia

21 Tax Deadline Calendar

Introduction To Affordable Care Act Health Coverage Returns Air

Draft 21 Aca Reporting Forms Issued By Irs The Aca Times

New Form 1095 C Draft Issued By Irs For Filing In 22 Bernieportal

Aca Forms 1094 1095 Reporting Deadline Extended Educational Benefits

21 Aca Form 1095 C Line 14 16 Code Sheet By Acawise Issuu

Aca Reporting Requirement What Employers Need To Know

Final Forms 1094 C 1095 C Issued And Deadline Extended For Forms 1095 C Schulman Insurance

Irs Extends Deadline For Furnishing Form 1095 C To Employees Extends Good Faith Transition Relief For The Final Time Hmk

Irs Provides Transition Relief For Aca Reporting Hays Companies

Your Complete Guide To Aca Forms 1094 C And 1095 C

Form Irs 1094 C Fill Online Printable Fillable Blank Pdffiller

Form 1095 C Furnishing Deadline Extended By Irs Basic

Irs Form 1094 C Form 1094 C Online 1095 C Transmittal Form

21 Irs Deadlines To Avoid Aca Penalties The Aca Times

Irs E Filing Deadline March 31 22 Aca Gps

Irs Extends Deadline For Certain Aca Reporting Forms Hrwatchdog

1094 C Electronic Filing Deadline June 30 Leavitt Group News Publications

Shop Paper Products 1095 Forms 1094 C Greatland Com

Irs Extends Deadline For Furnishing Form 1095 C Extends Good Faith Transition Relief Fedeli Group

1094 C

Irs 1094 C 16 Fill Out Tax Template Online Us Legal Forms

Deadlines Ahead As Employers Prep For Aca Reporting In 21

Compliance Deadline Extended For Form 1095 To Individuals

Irs Extends Deadline For Employer Aca Disclosures Buck Buck

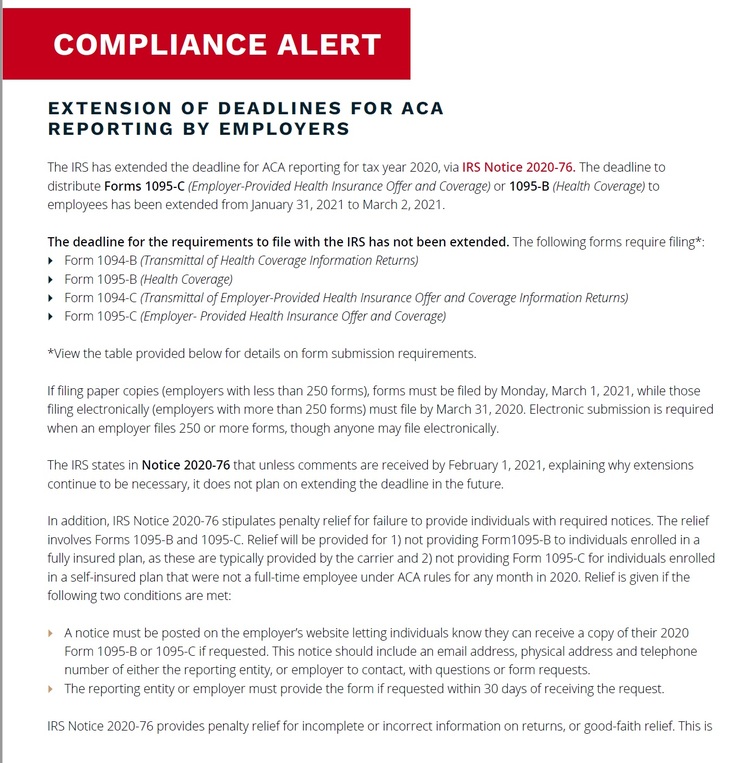

Extension Of Deadlines For Aca Reporting By Employers Ncw Insurance In Amarillo Texas

Affordable Care Act Aca Reporting Cheat Sheet Reporting Made Easy Onedigital

Pgpbenefits Com

21 Aca Reporting Is Due In Early 22 Hr Works

Changes In 21 Aca Reporting Employment How To Plan Health Insurance Coverage

Irs Extends Aca Reporting Deadline For Furnishing Statements For From February 1 To March 2 21 Innovative Benefit Planning

Irs S Draft 21 Aca Reporting Forms And Instructions Incorporate Some Expected Changes Omit Others

Form 1094 C 1095 C Reporting Basics And Ale Calculator Bernieportal

Graydon Law

Irs Issues Draft Form 1095 C For Aca Reporting In 21

Aca Compliance Filing Deadlines For The 18 Tax Year

Aca Deadlines Penalties Extension For 21 Checkmark Blog

1095 C Submit Your 1095 C Form Onlinefiletaxes Com

Good News Irs Extends 1095 C Reporting Deadline And Good Faith Transition Relief For 18 Reporting Integrity Data

Irs Form 1094 C Download Fillable Pdf Or Fill Online Transmittal Of Employer Provided Health Insurance Offer And Coverage Information Returns Templateroller

Irs Extends Form 1095 C Distribution Deadline Once Again Sgr Law

Irs Reporting Under The Affordable Care Act Bkd Llp

Corpsyn Com

Wordandbrown Com

Irs Announces Relief For Certain Form 1094 1095 Reporting Requirements Mcafee Taft

State Individual Mandates Add To Employer Reporting Responsibilities Foster Foster

Alert Irs Extends Due Date For Forms 1095 C And 1095 B

Irs Form 1094 C Download Fillable Pdf Or Fill Online Transmittal Of Employer Provided Health Insurance Offer And Coverage Information Returns Templateroller

Affordable Care Act Employers Lawyers Blog Holland Hart Llp

1095 C Reporting Determining A Company S Ale Status Integrity Data

3

Instructions For Forms 1095 C Taxbandits Youtube

Payroll Systems Things To Consider When Filing Forms 1095 C 1094 C Payroll Systems

Irs 1094 C 21 Fill Out Tax Template Online Us Legal Forms

New Deadline Final Year Of Good Faith Relief For Aca Reporting Etc

Form 1095 C Furnishing Deadline Extended By Irs Basic

Form 1094 C And Form 1095 C B Benchmark Planning Group

Free Small Business And Hr Compliance Calendar March 21 Workest

0 件のコメント:

コメントを投稿